Discover the Power of the Bar Gaps Indicator: Analyzing Order Flow and Price Action to Uncover Valuable Insights

Gain a Competitive Edge in Trading by Leveraging the Bar Gaps Indicator for NinjaTrader 8

Bar Gaps Indicator Gives You An Edge

- Identify shifts in the order flow.

- Detect market trends as they occur.

- Focus on the institutional order flow.

- Keep you on the right side of the market movement.

What Can You Do With The Bar Gaps Indicator?

Identification of Market Imbalances

The Bar Gaps indicator combines price action and order flow analysis to help identify market imbalances between buyers and sellers. By understanding the order flow dynamics, traders can potentially spot situations where institutional traders are actively participating, leading to significant price movements.

Insights into Market Sentiment

By analyzing institutional order flow, not just regular order flow, traders will align themselves with these larger market participants, who are often considered the "smart money." This alignment can provide traders with a potential edge in their trading decisions.

Confirmation of Price Movements

Order flow analysis helps confirm or validate price movements. By examining the actions of institutional traders, traders using the Bar Gaps indicators seek confirmation of trends, breakouts, or reversals. This confirmation can increase confidence in trading signals and potentially improve trade outcomes.

Enhanced Risk Management

By incorporating the Bar Gaps indicator into your trading strategy, you can better manage your risk. The bar gaps can act as reference points for setting stop-loss levels and profit targets. Traders can adjust their position sizing and risk-reward ratios accordingly, leading to more effective risk management.

Hi, I'm Michael Valtos, a recognized authority in order flow trading and analysis. With decades of experience in the industry, I have established myself as a leading expert, sharing my knowledge through books and seminars worldwide. Throughout my extensive trading career, I have honed my skills in order flow analysis and developed my own software tailored for effective trading based on this approach.

My trading career began nearly 30 years ago, primarily on the institutional side of the market. I have had the privilege of trading for renowned institutions such as JP Morgan for eight years, Cargill for four years, Commerzbank for three years, and EDF Man for two years. These experiences have provided me with invaluable insights into the workings of the financial markets and the intricacies of order flow dynamics.

I started my trading career in 1994 on the CME Floor with Dean Witter, laying the foundation for my deep understanding of market dynamics and the importance of order flow analysis. This hands-on experience has greatly contributed to my expertise in identifying and capitalizing on order flow trading opportunities.

Nowadays, I am dedicated to sharing my knowledge and insights with fellow traders, empowering them to navigate the complexities of the market through the lens of order flow trading. I continue to stay at the forefront of this field, driven by my passion for helping traders achieve their goals and enhance their trading strategies.

My trading career began nearly 30 years ago, primarily on the institutional side of the market. I have had the privilege of trading for renowned institutions such as JP Morgan for eight years, Cargill for four years, Commerzbank for three years, and EDF Man for two years. These experiences have provided me with invaluable insights into the workings of the financial markets and the intricacies of order flow dynamics.

I started my trading career in 1994 on the CME Floor with Dean Witter, laying the foundation for my deep understanding of market dynamics and the importance of order flow analysis. This hands-on experience has greatly contributed to my expertise in identifying and capitalizing on order flow trading opportunities.

Nowadays, I am dedicated to sharing my knowledge and insights with fellow traders, empowering them to navigate the complexities of the market through the lens of order flow trading. I continue to stay at the forefront of this field, driven by my passion for helping traders achieve their goals and enhance their trading strategies.

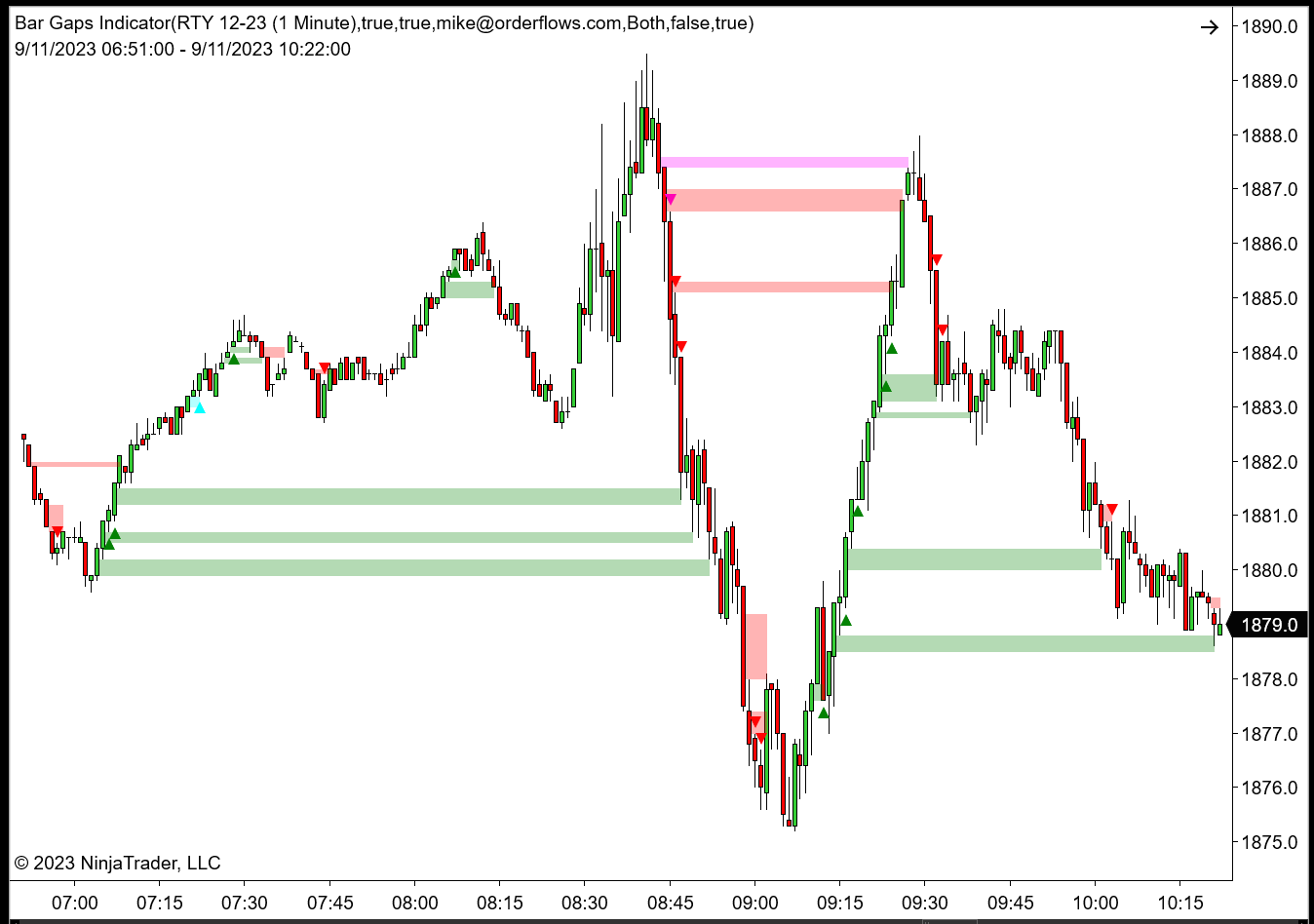

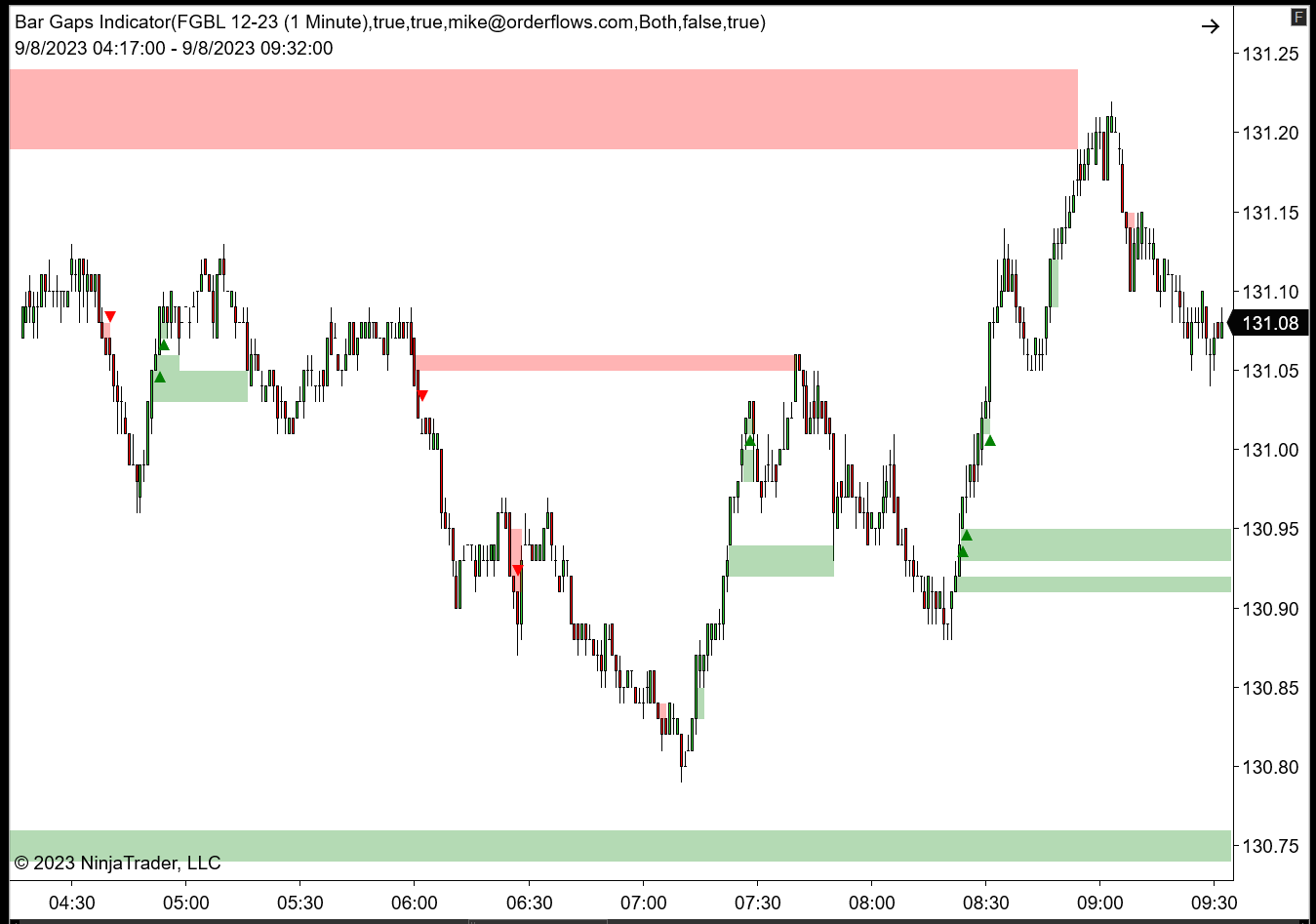

Let's dive into the Bar Gaps Indicator, a remarkable tool designed specifically for NinjaTrader 8. This indicator goes beyond conventional analysis by meticulously examining order flow and price action on a bar-by-bar basis. By doing so, it uncovers valuable gaps in value that provide deep insights into institutional activity, market sentiment, and current market dynamics.

So, what exactly is the Bar Gaps Indicator? The Bar Gap Indicator is loosely based on the Fair Value Gap which is a unique price pattern observable on a three-candle chart. This pattern is characterized by a prominent candle in the center, flanked by two candles possessing wicks that do not encompass the same range.

The occurrence of this pattern implies a precipitous rise or fall in price, with little opportunity for market participants, whether buyers or sellers, to react. Such a scenario often leads to a market imbalance.

This price pattern underscores market disparities brought about by swift price fluctuations.

However, the Fair Value Gap by itself is not enough. When adding order flow analysis to it, a trader can take better advantage of the pattern.

But what sets the Bar Gaps Indicator apart from other tools? It's all about accuracy, reliability, and depth of analysis. The Bar Gaps Indicator has been meticulously crafted using advanced algorithms and extensive research. Its precision ensures that you receive accurate insights into institutional activity, allowing you to navigate the market with confidence.

Moreover, the Bar Gaps indicator serves as your personal guide, revealing crucial market information in real-time. You'll receive timely alerts and customizable visual cues that keep you informed of gap occurrences. It's like having a seasoned trading mentor by your side, pointing out potential opportunities for profitable trades.

Now, let's address the skeptics among us. Some may question whether analyzing order flow and price action can truly provide valuable insights. But think about it - institutions and big players leave footprints in the market. By closely studying the order flow and price action, we can decode these footprints and gain a deeper understanding of market sentiment.

So, how can you harness the power of the Bar Gaps Indicator? It's simple. Integrate it into your NinjaTrader 8 platform and explore its capabilities. Customize it to fit your trading style and preferences. Dive deep into the world of order flow analysis and unlock the potential of gap analysis.

Remember, successful trading requires staying ahead of the game. The Bar Gaps Indicator equips you with the tools to understand institutional activity, decipher market sentiment, and make informed trading decisions.

Take charge of your trading journey today and discover the power of the Bar Gaps Indicator for NinjaTrader 8. Embrace its insights, seize hidden opportunities, and elevate your trading to new heights.

So, what exactly is the Bar Gaps Indicator? The Bar Gap Indicator is loosely based on the Fair Value Gap which is a unique price pattern observable on a three-candle chart. This pattern is characterized by a prominent candle in the center, flanked by two candles possessing wicks that do not encompass the same range.

The occurrence of this pattern implies a precipitous rise or fall in price, with little opportunity for market participants, whether buyers or sellers, to react. Such a scenario often leads to a market imbalance.

This price pattern underscores market disparities brought about by swift price fluctuations.

However, the Fair Value Gap by itself is not enough. When adding order flow analysis to it, a trader can take better advantage of the pattern.

But what sets the Bar Gaps Indicator apart from other tools? It's all about accuracy, reliability, and depth of analysis. The Bar Gaps Indicator has been meticulously crafted using advanced algorithms and extensive research. Its precision ensures that you receive accurate insights into institutional activity, allowing you to navigate the market with confidence.

Moreover, the Bar Gaps indicator serves as your personal guide, revealing crucial market information in real-time. You'll receive timely alerts and customizable visual cues that keep you informed of gap occurrences. It's like having a seasoned trading mentor by your side, pointing out potential opportunities for profitable trades.

Now, let's address the skeptics among us. Some may question whether analyzing order flow and price action can truly provide valuable insights. But think about it - institutions and big players leave footprints in the market. By closely studying the order flow and price action, we can decode these footprints and gain a deeper understanding of market sentiment.

So, how can you harness the power of the Bar Gaps Indicator? It's simple. Integrate it into your NinjaTrader 8 platform and explore its capabilities. Customize it to fit your trading style and preferences. Dive deep into the world of order flow analysis and unlock the potential of gap analysis.

Remember, successful trading requires staying ahead of the game. The Bar Gaps Indicator equips you with the tools to understand institutional activity, decipher market sentiment, and make informed trading decisions.

Take charge of your trading journey today and discover the power of the Bar Gaps Indicator for NinjaTrader 8. Embrace its insights, seize hidden opportunities, and elevate your trading to new heights.

What Makes The Bar Gaps Indicator Unique?

Institutional Participation

Bar gaps are closely linked to the activities of institutional traders. By analyzing the characteristics of bar gaps, traders can attempt to gauge the intentions and actions of these influential market participants. Understanding institutional behavior provides an edge in anticipating market movements and identifying potential trading opportunities.

Entry and Exit Signals

Bar gaps, which is combined with price action and order flow volume analysis, generates powerful entry and exit signals. Bar gaps indicate strong buying or selling pressure, presenting favorable trading opportunities. Traders can use these bar gaps as signals to enter or exit trades, enhancing the timing and precision of their trading decisions.

Market Structure Analysis

Bar gaps combined with price action and order flow volume analysis provide valuable insights into the underlying market structure. By studying these gaps, traders can identify key support and resistance levels, trend reversals, and areas of significant buying or selling pressure. This analysis helps traders make more informed decisions and align their trades with the prevailing market dynamics.

What Are Some Of The Ways To Use The Bar Gaps Indicator?

For Short-Term Traders: Let the Bar Gaps Indicator Show You With Up/Down Signal Triangles, which Bar Gaps are best for trading. Just Because A Gap Occurred Doesn't Mean You Want To Blindly Trade Every One. There Needs To Be Complimentary Order Flow.

For Swing Traders: If You Want To Just Know Which Bar Gaps Are Acting As Support/Resistance Levels, The Bar Gaps Indicator Can Simply Draw Out The Support/Resistance Levels That Matter The Most. The Ones That You Should Expect The Market To Come Back To And Retest.

For Order Flow Traders Who Trade Around Levels: Combine Both The Signals & Support/Resistance Levels To Give You A Clear Picture Of What Is Happening In The Market And Show You Which Trades To Take.

The Charts Speak For Themselves

The Bar Gaps Indicator Takes The Order Flow Information, Couples It With Price Action, & Gives You Trade Opportunities.

Bar Gaps Works On Footprint Charts As Well As Candlestick Charts

Stay ahead of the game, adapt to market shifts, and maximize your trading success.

Get The Bargaps Indicator for NinjaTrader 8 (NT8)

Now For Just $197

Now For Just $197

Once your payment has been processed, the Bargaps indicator will be sent to the email address you used to complete your PayPal transaction. All emails are usually sent within 3-6 hours. Usually much sooner.

The Bar Gaps indicator is NOT a footprint chart. It is a stand-alone indicator that is designed to run on different chart types. It will run on a footprint chart as well as a regular bar or candlestick chart.

Q. How do I access the indicator after purchasing?

A. Once your payment has been processed, the Bar Gaps indicator will be sent to the email address you used to complete your PayPal transaction. All emails are usually sent within 3-6 hours. Usually much sooner.

Q. What trading platform does the Bar Gaps run on?

A. Bar Gaps runs on the desktop version of NinjaTrader 8, both the free and paid version.

Q. Is there an MT4/5 or Sierra Chart version of this indicator?

A. No, currently the Bar Gaps is only available for NinjaTrader 8.

Q. I am a short term trader, I look at the DOM and tick charts. Will Bar Gaps help me?

A. Yes. Bar Gaps analyzes volume traded on the bid and volume on the offer. I prefer to run Bar Gaps on charts ranging from 30-seconds to 1-minute to 15-minutes and range charts between 4 range and 10 range as well as tick and volume based charts.

Q. When I load Bar Gaps on my chart I don't see any arrows?

A. You have to make sure you enable your license. After you enter your email to register your license, you MUST click the box above where you entered your email to enabled you license.

Q. How many PCs can I run Bar Gaps on?

A. You can run the Bar Gaps indicator on multiple PCs.

A. Once your payment has been processed, the Bar Gaps indicator will be sent to the email address you used to complete your PayPal transaction. All emails are usually sent within 3-6 hours. Usually much sooner.

Q. What trading platform does the Bar Gaps run on?

A. Bar Gaps runs on the desktop version of NinjaTrader 8, both the free and paid version.

Q. Is there an MT4/5 or Sierra Chart version of this indicator?

A. No, currently the Bar Gaps is only available for NinjaTrader 8.

Q. I am a short term trader, I look at the DOM and tick charts. Will Bar Gaps help me?

A. Yes. Bar Gaps analyzes volume traded on the bid and volume on the offer. I prefer to run Bar Gaps on charts ranging from 30-seconds to 1-minute to 15-minutes and range charts between 4 range and 10 range as well as tick and volume based charts.

Q. When I load Bar Gaps on my chart I don't see any arrows?

A. You have to make sure you enable your license. After you enter your email to register your license, you MUST click the box above where you entered your email to enabled you license.

Q. How many PCs can I run Bar Gaps on?

A. You can run the Bar Gaps indicator on multiple PCs.

Q. What timeframes does the indicator work on?

A. Order flow is best utilized on short time frames. Bar Gaps is best utilized on charts ranging from 30-seconds to 1-minute to 15-minutes and range charts between 4 range and 10 range as well as tick and volume based charts.

Q. Do I need tick replay to run Bar Gaps?

A. No, you do not need to use tick replay to see Bar Gaps on historical charts. If you use Bar Gaps with an indicator that require tick replay, you can still Bar Gaps with tick replay enabled.

Q. Is Bar Gaps a footprint chart and does one come with it?

A. No, Bar Gaps analyzes the data from the order flow so you do not need a footprint chart or a market depth chart.

Q. Do I need the Orderflows Trader software to run Bar Gaps?

A. No. Bar Gaps is a stand-alone indicator that interprets the order flow liquidity and price action in the market.

Q. Do I need Level 2 data to run Bar Gaps?

A. No, Bar Gaps will run on normal Level 1 data.

Q. Do I need to use a footprint chart to use Bar Gaps?

A. No. Bar Gaps will run on any chart type. It will run on regular bar charts, candlesticks charts. Just about any chart you use, it can be run on.

Q. Do you offer a free trial?

A. Unfortunately no.

A. Order flow is best utilized on short time frames. Bar Gaps is best utilized on charts ranging from 30-seconds to 1-minute to 15-minutes and range charts between 4 range and 10 range as well as tick and volume based charts.

Q. Do I need tick replay to run Bar Gaps?

A. No, you do not need to use tick replay to see Bar Gaps on historical charts. If you use Bar Gaps with an indicator that require tick replay, you can still Bar Gaps with tick replay enabled.

Q. Is Bar Gaps a footprint chart and does one come with it?

A. No, Bar Gaps analyzes the data from the order flow so you do not need a footprint chart or a market depth chart.

Q. Do I need the Orderflows Trader software to run Bar Gaps?

A. No. Bar Gaps is a stand-alone indicator that interprets the order flow liquidity and price action in the market.

Q. Do I need Level 2 data to run Bar Gaps?

A. No, Bar Gaps will run on normal Level 1 data.

Q. Do I need to use a footprint chart to use Bar Gaps?

A. No. Bar Gaps will run on any chart type. It will run on regular bar charts, candlesticks charts. Just about any chart you use, it can be run on.

Q. Do you offer a free trial?

A. Unfortunately no.

All rights reserved | Copyright Bargaps.com 2023

Disclaimer and Risk Disclosure:

CFTC Rules 4.41: Hypothetical or Simulated performance results have certain limitations, unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.

Disclaimer:

This presentation is for educational and informational purposes only and should not be considered a solicitation to buy or sell a futures contract or make any other type of investment decision. Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Risk Disclosure:

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

Disclaimer and Risk Disclosure:

CFTC Rules 4.41: Hypothetical or Simulated performance results have certain limitations, unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.

Disclaimer:

This presentation is for educational and informational purposes only and should not be considered a solicitation to buy or sell a futures contract or make any other type of investment decision. Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Risk Disclosure:

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

Thanks for subscribing. Share your unique referral link to get points to win prizes..

Loading..